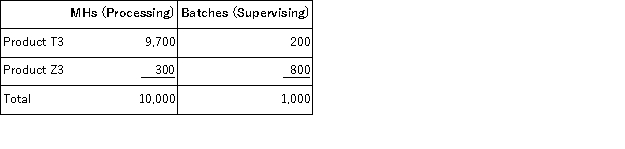

Glassey Corporation uses activity-based costing to assign overhead costs to products.Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $20, 000;Supervising, $33, 500;and Other, $16, 500.Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:  The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Employer

An individual or organization that hires and pays people for their work.

Digital Millennium Copyright Act

A U.S. law that addresses the rights of copyright holders in the digital age, imposing limitations on the use of copyrighted digital materials.

Copyright Infringement

The violation of copyright laws by reproducing, distributing, displaying, or performing a protected work without permission from the copyright holder.

Fair Use

A legal doctrine that allows limited use of copyrighted material without permission for purposes like criticism, commentary, or education.

Q6: (Ignore income taxes in this problem. )Baldock

Q42: Tillison Corporation makes three products that use

Q59: Buth Inc.uses a job-order costing system in

Q77: In the payback method, depreciation is deducted

Q93: Caber Corporation applies manufacturing overhead on the

Q117: Oruro Chemical Corporation manufactures a variety of

Q126: Thoen Nuptial Bakery makes very elaborate wedding

Q127: One way to compute the total contribution

Q136: Lake Corporation has an activity-based costing system

Q144: Rollison Corporation has two divisions: Retail Division