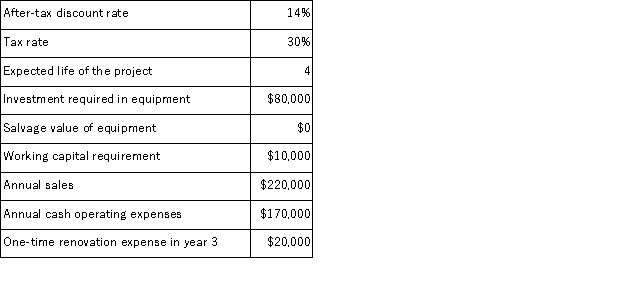

(Appendix 8C) Stars Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

Definitions:

FUTA Expense

The total cost incurred by an employer for the Federal Unemployment Tax, contributing to the U.S. government's unemployment fund.

Form 941

A federal tax form used by employers to report quarterly income taxes, social security tax, and Medicare tax withheld from employees' paychecks.

Form 940

A tax form filed by employers to report annual Federal Unemployment Tax Act (FUTA) tax.

Form W-2

An IRS tax form used in the United States to report wages paid to employees and the taxes withheld from them.

Q7: Infants as young as one month can

Q18: (Appendix 8C)Lasater Corporation has provided the following

Q21: (Appendix 5A)Sirmons Corporation manufactures and sells one

Q36: (Appendix 11A)Stenquist Corporation has provided the following

Q47: The management of Tamondong Corporation has provided

Q48: If the unit sales for one product

Q53: Eakins Corporation has just developed a new

Q60: Daisley Products Inc.makes two products-B17U and R94X.Product

Q64: (Appendix 11A)The Murray Corporation makes and sells

Q88: When computing standard cost variances, the difference