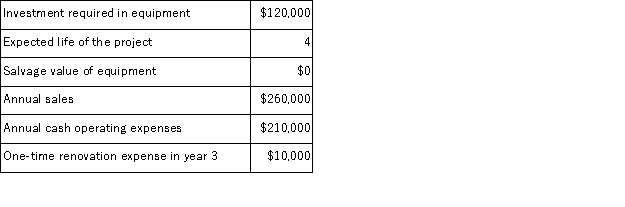

(Appendix 8C)Gloden Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation.The depreciation expense will be $30, 000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 35% and the after-tax discount rate is 12%.

The company uses straight-line depreciation.The depreciation expense will be $30, 000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 35% and the after-tax discount rate is 12%.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Q3: Your friend Clyde would like his five-year-old

Q8: (Appendix 12A)Division X makes a part that

Q23: (Appendix 11A)Oldham Corporation bases its predetermined overhead

Q34: As children develop, they learn more about

Q37: School-age children are more likely to be

Q82: _ is/are a system that relates sounds

Q97: (Appendix 11A)Tropiano Electronics Corporation has a standard

Q97: (Appendix 8C)Pont Corporation has provided the following

Q102: (Appendix 8C)Kostka Corporation is considering a capital

Q116: (Appendix 8C)Erling Corporation has provided the following