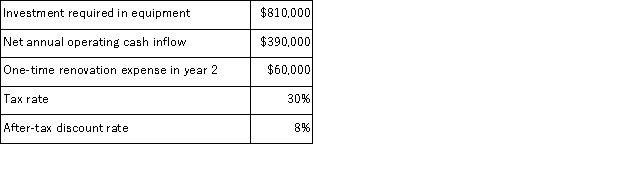

(Appendix 8C)Holzner Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $270, 000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $270, 000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Criterion

A standard or principle by which something may be judged or decided, often used in assessments or decision-making processes.

Expressive Needs

Emotional or social needs that involve seeking emotional support, love, belonging, and self-expression.

Instrumental Needs

Emotionally neutral, task-oriented (goal-oriented) needs.

Secondary Groups

Groups characterized by impersonal, formal, and business-like relationships, often temporary and based on a specific purpose or goal.

Q3: (Appendix 4B)The management of Lewinski Corporation would

Q10: (Appendix 11A)A company has a standard cost

Q12: (Appendix 12A)The Red River Division of Alto

Q19: (Appendix 2A)Escalona Printing Corp. , a book

Q32: Roger is fascinated with learning the meanings

Q38: (Appendix 12B)Charlie Company has provided the following

Q80: (Appendix 8C)Flippo Corporation is considering a capital

Q115: (Appendix 8C)Crabill Corporation has provided the following

Q120: (Appendix 8C)Santistevan Corporation has provided the following

Q134: (Appendix 8C)Battaglia Corporation is considering a capital