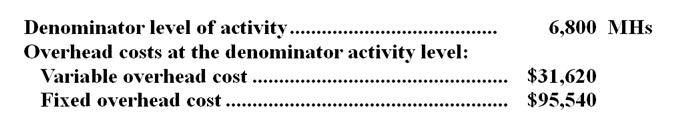

A manufacturing company uses a standard costing system in which standard machine-hours (MHs) is the measure of activity. Data from the company's flexible budget for manufacturing overhead are given below: The following data pertain to operations for the most recent period:

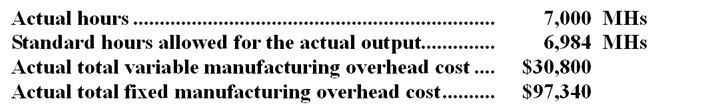

The following data pertain to operations for the most recent period:

-What is the predetermined overhead rate to the nearest cent?

Definitions:

IRR Method

The IRR method, or Internal Rate of Return method, is a financial analysis tool used to evaluate the profitability of an investment by calculating the interest rate at which net present value of all the cash flows (both positive and negative) from a project or investment equals zero.

Cost of Capital

The rate of return required by a company to undertake an investment or project, often used as a discount rate in capital budgeting.

Payback Method

A capital budgeting technique that calculates the time required to recoup the cost of an investment, ignoring the time value of money.

MIRRs

Modified Internal Rate of Return (MIRR) is a financial metric used to assess the profitability of investments, adjusting the internal rate of return (IRR) to account for differences in the reinvestment rate and financing costs.

Q13: The medical supplies in the flexible budget

Q30: Block Corporation makes three products that use

Q53: Igel Corporation makes a product with the

Q76: Wright Company produces products I,J,and K from

Q90: The materials quantity variance is:<br>A)$800 U<br>B)$4,000 U<br>C)$760

Q100: Masse Corporation uses part G18 in one

Q106: The constraint at Vrana Inc.is an expensive

Q109: The activity variance for administrative expenses in

Q121: If the discount rate is 10%,the net

Q130: Prevatte Corporation purchases potatoes from farmers.The potatoes