Addy Company makes two products: Product A and Product B. Annual production and sales are 1,700 units of Product A and 1,100 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labor-hours per unit and Product B requires 0.6 direct labor-hours per unit. The total estimated overhead for next period is $98,785.

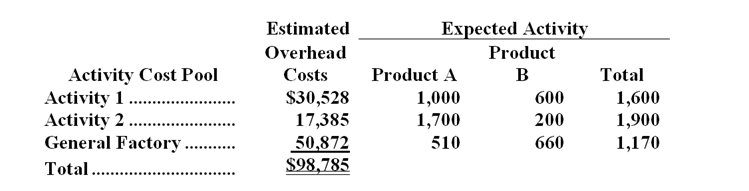

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows: (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The overhead cost per unit of Product B under the activity-based costing system is closest to:

Definitions:

Debt-to-Equity Ratio

A financial ratio used to measure the relative proportion of shareholders' equity and debt used to finance a company's assets.

Times Interest Earned

A metric indicating a firm's capability to cover its debt payments, by contrasting its earnings before interest and taxes with its interest costs.

Interest Expense

The cost incurred by an entity for borrowed funds, representing the interest payments made on any borrowed capital.

Tax Rate

is the percentage at which an individual or corporation is taxed by the government.

Q1: A direct labor worker at Gallet Corporation

Q4: The predetermined overhead rate under the traditional

Q4: An example of a substantive test always

Q8: Brew Corporation's most recent comparative statement of

Q12: Under the direct method,sales adjusted to a

Q25: Kirsch Corporation's standard wage rate is $13.40

Q37: IT general controls are driven by the

Q49: Stanley Morgan has learned that it is

Q55: Rabin Corporation uses the FIFO method

Q69: The fixed portion of the predetermined overhead