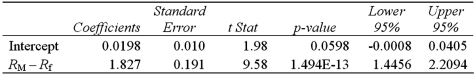

Exhibit 15-6.Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  Refer to Exhibit 15-6.When testing whether the beta coefficient is significantly greater than one,the relevant critical value at the 5% significance level is

Refer to Exhibit 15-6.When testing whether the beta coefficient is significantly greater than one,the relevant critical value at the 5% significance level is  .The conclusion to the test is:

.The conclusion to the test is:

Definitions:

State

A political entity characterized by a defined territory, permanent population, government, and capacity to enter into relations with other states.

Concurrent Jurisdiction

Exists when two or more courts from different systems simultaneously have jurisdiction over a specific case.

Federal Court

A branch of the United States judicial system where federal matters, including civil and criminal cases that involve federal law, are resolved.

Defendant

A person or entity against whom a legal action is brought in a court of law.

Q11: Suppose you want to determine if mutual

Q22: The chi-square test of a contingency table

Q36: Jake Morris invested $150 in buying a

Q55: Fisher's 100(1 - α)% confidence interval for

Q69: Which of the following formulas is used

Q72: Compute a 98% confidence interval for the

Q79: The capital asset pricing model is given

Q88: Covariance can be used to determine if

Q90: Exhibit 10.6.A university wants to compare out-of-state

Q97: Exhibit 15-8.A real estate analyst believes that