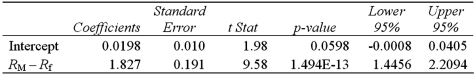

Exhibit 15-6.Tiffany & Co.has been the world's premier jeweler since 1837.The performance of Tiffany's stock is likely to be strongly influenced by the economy.Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) .The accompanying table shows the regression results when estimating the CAPM model for Tiffany's return.  Refer to Exhibit 15-6.When testing whether the beta coefficient is significantly greater than one,the relevant critical value at the 5% significance level is

Refer to Exhibit 15-6.When testing whether the beta coefficient is significantly greater than one,the relevant critical value at the 5% significance level is  .The conclusion to the test is:

.The conclusion to the test is:

Definitions:

Government Programs

Initiatives and projects undertaken by the government aimed at improving the welfare of its citizens, often in areas like health, education, and social security.

Substance Abuse Policy

Organizational rules and guidelines designed to manage the use and consequences of drugs and alcohol abuse within the workplace.

National Level

A scale of analysis or operation that pertains to an entire country as opposed to local or regional levels.

Self-Sabotage

Engaging in behaviors or thought patterns that hinder one's own success or well-being.

Q4: Exhibit 10.5.A producer of fine chocolates believes

Q6: Exhibit 15-1.An marketing analyst wants to examine

Q31: Exhibit 13.6 A researcher wants to understand

Q33: Given the following portion of regression results,which

Q59: Exhibit 19-6.Three firms X,Y,and Z operate in

Q73: Exhibit 19-3.Consider the following information about the

Q77: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg" alt="Find and

Q81: A manager at a ski resort in

Q88: Covariance can be used to determine if

Q95: Exhibit 17.1.A researcher has developed the following