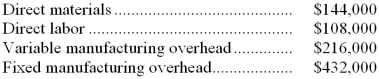

During its first year of operations, Holt Manufacturing Company incurred the following costs to produce 200,000 units of its only product:  Holt also incurred the following costs in the sale of 180,000 units of product during its first year:

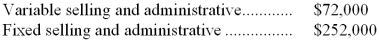

Holt also incurred the following costs in the sale of 180,000 units of product during its first year:  Assume that direct labor is a variable cost.

Assume that direct labor is a variable cost.

-What would be the cost per unit of Holt's finished goods inventory at the end of the first year of operations under the variable costing method?

Definitions:

Strategic Planning

The development of a long-range course of action to achieve business goals.

Transfer Pricing

The pricing of goods, services, or intangible property transferred within divisions of the same company, which can impact taxation and profit allocation.

Division Manager

A managerial position responsible for overseeing a specific division within a company, making key decisions related to that segment's operation.

Overall Company Income

The total earnings generated by a company, encompassing all sources of income before deductions or taxes.

Q5: If the budgeted direct labor cost for

Q13: The manufacturing overhead budget at Ferrucci Corporation

Q20: In a cash budget for March, the

Q40: The best estimate of the company's variable

Q47: The break-even in monthly dollar sales is

Q61: Mcferrin Corporation manufactures a variety of products.

Q92: Which of the following costs at a

Q106: During March, Holston Corporation plans to serve

Q117: The break-even point in annual sales dollars

Q290: The spending variance for direct materials in