Bob is a quality inspector on the assembly line of a manufacturing company. He is paid $16 per hour for regular time and time and a half for all work in excess of 40 hours per week. He is classified as a direct labor worker.

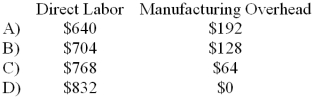

-Bob works 48 hours in a given week but is idle for 4 hours during the week due to equipment breakdowns. The allocation of Bob's wages for the week between direct labor cost and manufacturing overhead cost would be:

Definitions:

Financial Statements

Formal records of the financial activities and position of a business, person, or other entity, typically including an income statement, balance sheet, and statement of cash flows.

Current Ratio

A liquidity ratio that measures a company's ability to pay short-term obligations, calculated as current assets divided by current liabilities.

Liquidity

The ease with which an asset can be converted into cash without affecting its market price.

Reduced Comparability

A situation where differences in accounting policies or external factors make it difficult to directly compare financial statements across periods or entities.

Q6: How much fixed manufacturing overhead was applied

Q15: _ is the development of all parts

Q16: How much of the $130,000 actual Food

Q22: Up to how much should the company

Q35: Letze Corporation would like to determine the

Q48: The number of errors found will be

Q49: The total Fabrication Department cost after service

Q57: One has to execute the system under

Q66: The type of documentation designed to describe

Q80: Macdowell Corporation's manufacturing overhead includes $2.50 per