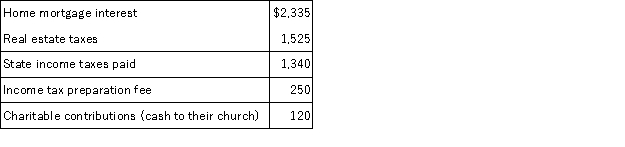

Misti purchased a residence this year. Misti is a single parent and lives with her 1-year old daughter. This year, Misti received a salary of $63,000 and made the following payments:

Misti files as a head of household and claims two exemptions. Calculate her taxable income this year.

Definitions:

Supreme Court

The highest judicial body in a country, typically having the final word in legal disputes and the authority to interpret the constitution.

Equal Protection Clause

A provision in the Fourteenth Amendment to the United States Constitution stating that no state shall deny to any person within its jurisdiction "the equal protection of the laws."

Fourteenth Amendment

An amendment to the U.S. Constitution granting citizenship to all persons born or naturalized in the United States, including former slaves, and guaranteeing all citizens equal protection under the law.

Public School Segregation

The practice of separating children in schools based on race, which has been ruled unconstitutional in the United States.

Q8: Investment expenses treated as miscellaneous itemized deductions

Q8: The test for whether an expenditure is

Q9: Assume that Marsha is indifferent between investing

Q13: Chuck has AGI of $70,000 and has

Q24: Tax credits reduce taxable income dollar for

Q46: Bryan is 67 years old and lives

Q52: All of the following represents a type

Q82: All of the following are tests for

Q89: Carey was researching a tax issue and

Q126: The tax law defines alimony to include