Consider the following to answer the question(s) below:

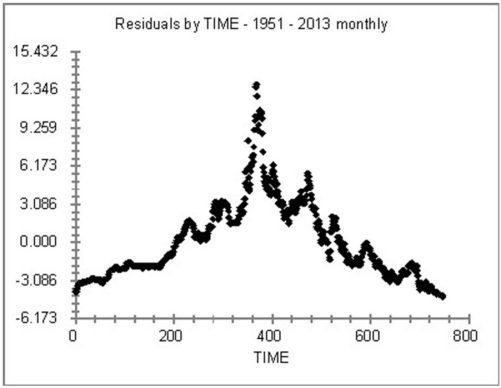

The average monthly residential mortgage lending rate in Canada is available monthly beginning in 1951. A scatterplot of the residuals against time for 747 months from January 1951 to March 2013 is shown below. The rate peaked in September of 1981 at 21.46%.  The Durbin-Watson statistic has a value of D = 0.01.

The Durbin-Watson statistic has a value of D = 0.01.

-The critical values for the Durbin-Watson statistic for α = 0.05 and n = 750 are: dL= 1.87736 and dU = 1.88270. What does this tell us about the assumption of the independence of the errors?

Definitions:

Annuity

A finance-related product that ensures a continual payment stream to a recipient, mainly used in planning for life after work.

Ordinary Annuity

Steady cash flows facilitated at the decline of each era during a certain season.

Nominal Interest

The rate of interest quoted on a loan or bond without adjusting for inflation or other factors that could affect the real rate of return.

Effective Rate

The actual interest rate on a loan or investment, taking into account the compounding of interest, as opposed to the nominal rate.

Q4: An Internet service provider has the capability

Q6: The greatest integer function is defined by

Q13: The calculated t-statistic to determine if Literacy

Q15: The regression equation, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6867/.jpg" alt="The regression

Q19: If the point in the lower left

Q22: A new movie is in the making

Q24: The option to buy extended warranties is

Q27: Of the consumers who are male, the

Q36: To show that <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5596/.jpg" alt="To show

Q67: What is the probability that a randomly