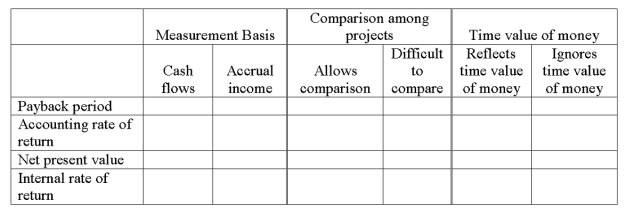

For each of the capital budgeting methods listed below, place an X in the correct column, indicating the measurement basis of each, the ability to make comparison among projects, and whether each method reflects or ignores the time value of money.

Definitions:

Fixed Costs

Expenses that do not change with the level of production or sales, examples include rent, salaries, and insurance premiums.

Variable Cost

Expenses that change in proportion to the activity or volume of business, such as materials, labor, and transaction fees.

Depreciation Expense

An accounting method of allocating the cost of a tangible asset over its useful life to represent wear and tear over time.

Variable Costs

Expenses that directly fluctuate according to the volume of production or sales.

Q14: According to advocates, some rights that victims

Q16: Pseudomemories are _.<br>A) a form of post-traumatic

Q21: The process of rediscovery usually unfolds through

Q24: Regarding overhead costs, as volume increases:<br>A) Unit

Q27: If the straight-line depreciation method is used,

Q40: Kent Company anticipates total sales for April,

Q52: A company is considering two projects, Project

Q83: The financial budgets of a business include

Q91: The master budget process nearly always begins

Q170: Quantity variances for direct cost categories (direct