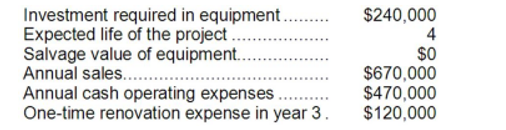

Foucault Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 12%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

Definitions:

SUD Treatment Admissions

The process of entering into a program or facility for the treatment of substance use disorders.

Ambulatory IOP

Ambulatory Intensive Outpatient Program, a treatment option for substance use disorders that allows patients to live at home while receiving rigorous, scheduled therapy.

N-SSATS

The National Survey of Substance Abuse Treatment Services, a source of data on the location, characteristics, and use of alcohol and drug abuse treatment facilities.

SUD Treatment Facilities

Institutions dedicated to providing medical and therapeutic services for individuals struggling with Substance Use Disorders (SUDs), including detoxification, counseling, and rehabilitation programs.

Q16: Yacavone Corporation has two operating divisions--a Consumer

Q50: The acid-test ratio at the end of

Q51: Delfavero Corporation has provided the following data:

Q61: (Ignore income taxes in this problem.) Sturn

Q81: (Ignore income taxes in this problem.) Shiffler

Q81: The total cash flow net of income

Q88: The net present value of a proposed

Q104: The company's gross margin percentage for Year

Q151: Selling used equipment at book value for

Q182: The company's dividend yield ratio is closest