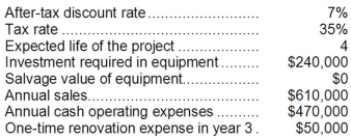

Milliner Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

Definitions:

Product Materials

The raw materials and substances used in the manufacture of a product.

Business Lunch

A meal event typically intended for discussing business matters, networking, or fostering professional relationships, often taking place during lunch hours.

Net Profit

Money remaining after costs of marketing and operating the business are paid.

Cost Of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs attributable to the production of the goods sold by a company, including materials and labor costs.

Q1: If the new equipment is purchased, the

Q17: (Ignore income taxes in this problem.) Janes,

Q28: The combined present value of the working

Q34: An increase in accounts receivable of $1,000

Q50: The total cash flow net of income

Q59: Globe Manufacturing Company has just obtained a

Q83: The net present value of the entire

Q146: The income tax expense in year 2

Q169: The company's book value per share at

Q257: The company's gross margin percentage for Year