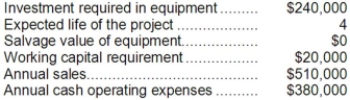

Hothan Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation. The depreciation expense will be $60,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 15%.

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation. The depreciation expense will be $60,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The income tax rate is 30% and the after-tax discount rate is 15%.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Intangible Factors

Aspects of a negotiation that are not physical or material but have significant influence, such as trust, brand value, and relationships.

Aspirations

Hopes or ambitions of achieving something.

Diagnosing

The process of identifying and understanding problems, conflicts, or conditions through systematic analysis.

Managing Coalitions

The process of organizing and guiding a temporary alliance or union of groups for a common cause.

Q4: The selling division in a transfer pricing

Q16: Assume the DVD Division's monthly production capacity

Q61: (Ignore income taxes in this problem.) Sturn

Q62: Adamyan Co. manufactures and sells medals for

Q71: Juett Company produces a single product. The

Q86: Mickolick Corporation has provided the following information

Q94: The net present value on this investment

Q135: In calculating the payback period where new

Q143: (Ignore income taxes in this problem.) Galindo

Q220: The company's dividend yield ratio for Year