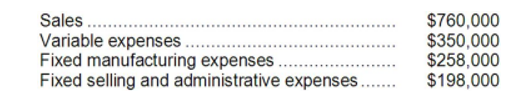

The management of Cackowski Corporation has been concerned for some time with the financial performance of its product I11S and has considered discontinuing it on several occasions. Data from the company's accounting system appear below:

In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $185,000 of the fixed manufacturing expenses and $132,000 of the fixed selling and administrative expenses are avoidable if product I11S is discontinued.

-According to the company's accounting system, what is the net operating income earned by product I11S? Include all costs in this calculation-whether relevant or not.

Definitions:

Debit Balance

An accounting entry that indicates the amount owed by a company, typically found on the left side of a ledger.

Work in Process Inventory

The value of partially completed goods that are still in the production process at a given point in time.

Underapplied Overhead

The situation where the allocated manufacturing overhead is less than the actual overhead incurred, leading to an adjustment need in accounting records.

Adjusting Entry

An accounting journal entry made to amend the preliminary financial records before preparing financial statements.

Q3: The net present value of the entire

Q8: The Adlake Corporation makes and sells a

Q23: The sales for Year 2 were:<br>A)$750,000<br>B)$2,000,000<br>C)$3,846,154<br>D)$2,400,000

Q35: The following direct labor standards have been

Q41: (Ignore income taxes in this problem.) Given

Q44: Omary Corporation has a standard cost system

Q50: Fruchter Corporation keeps careful track of the

Q62: Adamyan Co. manufactures and sells medals for

Q110: Pizzi, Inc. had the following fixed manufacturing

Q116: Holzner Corporation has provided the following information