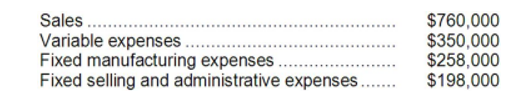

The management of Cackowski Corporation has been concerned for some time with the financial performance of its product I11S and has considered discontinuing it on several occasions. Data from the company's accounting system appear below:

In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $185,000 of the fixed manufacturing expenses and $132,000 of the fixed selling and administrative expenses are avoidable if product I11S is discontinued.

-According to the company's accounting system, what is the net operating income earned by product I11S? Include all costs in this calculation-whether relevant or not.

Definitions:

Marginal Rate

The rate of increase in a variable (e.g., tax rate, substitution, technical substitution) as another variable (e.g., income, quantity of another good) increases incrementally.

Increase

An upward movement in quantity, value, or some other measure, indicating growth or accumulation.

Income Taxed

A government levy on individual or corporate income.

Regressive Tax Structure

A tax system where the tax rate decreases as the taxable amount increases, placing a higher burden on low-income earners compared to high-income earners.

Q15: Compound B73G is used to make Vasconcellos

Q18: An unfavorable materials price variance is recorded

Q22: Rintharamy Corporation's management reports that its average

Q27: The net cash provided by (used in)

Q63: Gloden Corporation has provided the following information

Q82: The income tax expense in year 3

Q101: Acuff Corporation applies manufacturing overhead to products

Q102: The total cash flow net of income

Q123: Hothan Corporation has provided the following information

Q164: Bullinger Corporation has provided the following data