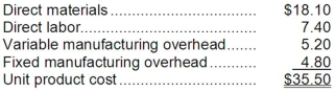

Tullius Corporation has received a request for a special order of 8,000 units of product C64 for $50.00 each. The normal selling price of this product is $53.25 each, but the units would need to be modified slightly for the customer. The normal unit product cost of product C64 is computed as follows:  Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product C64 that would increase the variable costs by $5.00 per unit and that would require a one-time investment of $43,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product C64 that would increase the variable costs by $5.00 per unit and that would require a one-time investment of $43,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.

Required:

Determine the effect on the company's total net operating income of accepting the special order. Show your work!

Definitions:

Resources

Inputs used in the production of goods and services, such as labor, capital, land, and entrepreneurship.

Marginal Rate

The rate at which one variable changes relative to a change in another variable, often used in the context of taxes or production costs.

Transformation

The process of changing something from one form or state to another, often seen in context with business, personal development, or technology.

Unemployment

The situation when people who are willing to work at prevailing wage rates cannot find employment.

Q4: Inspection Time is generally considered to be

Q20: The income tax expense in year 2

Q31: Hanson, Inc. makes 1,000 units per year

Q33: For purposes of measuring performance, how much

Q66: (Ignore income taxes in this problem.) Swaggerty

Q75: (Ignore income taxes in this problem.) Cascade,

Q106: Blue Corporation's standards call for 2,500 direct

Q109: If machine-hours is Madison's production constraint, then

Q123: Hothan Corporation has provided the following information

Q127: Opportunity costs are not usually recorded in