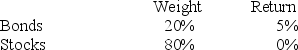

In a particular year, Razorback Mutual Fund earned a return of 1% by making the following investments in asset classes:

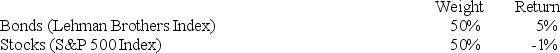

The return on a bogey portfolio was 2%, calculated from the following information.

The contribution of asset allocation across markets to the Razorback Fund's total excess return was

Definitions:

Affirmative Action

Policies or measures aimed at increasing opportunities for underrepresented groups in employment, education, and other areas.

Negative Associations

The connection found between two variables that move in opposite directions, where an increase in one leads to a decrease in the other, or vice versa; or the mental connection made by individuals between undesirable experiences and specific objects, concepts, or people.

Bona Fide Occupational Requirement

Entails a condition or qualification that is essential for performing a job, used as a legal defense in discrimination cases if it is reasonably necessary for the operation of the business.

Employment Equity Act

Legislation aimed at eliminating employment barriers and promoting equality within the workplace for women, indigenous peoples, persons with disabilities, and members of visible minorities.

Q1: What has global technology NOT lead to?<br>A)

Q8: The intrinsic value of an out-of-the-money call

Q12: What organizational factors are more likely to

Q18: Assume there is a fixed exchange rate

Q31: A safe driver who drives faster as

Q34: In 1980 the dollar-yen exchange rate was

Q38: A company that mines bauxite, an aluminum

Q48: The possibility of experiencing a drop in

Q79: An investor who goes short in a

Q81: Rose Hill Trading Company is expected to