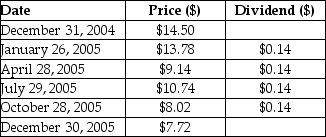

Consider the following price and dividend data for Quicksilver Inc.:

Assume that you purchased Quicksilver's stock at the closing price on December 31, 2004 and sold it after the dividend had been paid at the closing price on January 26, 2005. Your total return rate (yield) for this period is closest to ________.

Definitions:

Contribution Margin

The difference between sales revenue and variable costs, measuring the ability of a business to cover its fixed costs.

Sales Mix

Sales mix is the proportion of different products or services that a company sells, reflecting the variety of sales contributing to total revenue.

Units Sold

The total quantity of products or goods sold by a company during a specific period.

Relevant Range

The scope of activity levels within which the assumptions about fixed and variable costs in cost-volume-profit analysis remain valid.

Q14: Suppose you invest $15,000 by purchasing 200

Q14: A company issues a callable (at par)

Q31: Disposition effect is the tendency of individual

Q38: Use the table for the question(s) below.

Q48: What are callable bonds?

Q59: The price of Microsoft is $30 per

Q83: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5536/.jpg" alt=" An investor is

Q84: Epiphany is an all-equity firm with an

Q98: If the Federal Reserve were to change

Q107: Consider the following price and dividend data