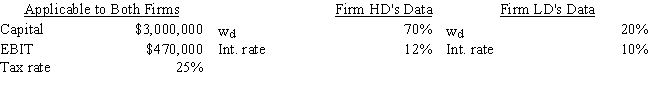

Firms HD and LD are identical except for their use of debt and the interest rates they pay--HD has more debt and thus must pay a higher interest rate.Both companies are small,so they are not subject to the interest deduction limitation.Based on the data given below,how much higher or lower will HD's ROE be versus that of LD,i.e. ,what is ROEHD - ROELD? Do not round your intermediate calculations.

Definitions:

Financial Structure

The mix of a company's liabilities and equity used to finance its assets, indicating how a company's operations are funded.

Balance Sheets

Financial statements that show a company's assets, liabilities, and equity at a specific point in time.

Fixed Assets

Long-term assets that a company uses in the production of its goods and services, such as buildings, machinery, and equipment, which are not expected to be converted into cash in the short term.

Investing Activity

Financial transactions related to an entity's investments in long-term assets, including property, plant, equipment, and securities.

Q23: Westchester Corp.is considering two equally risky,mutually exclusive

Q29: Companies can issue different classes of common

Q36: S.Bouchard and Company hired you as a

Q53: The standard deviation is a better measure

Q57: Assume that you are a consultant to

Q58: Which of the following statements is CORRECT?<br>A)

Q61: Classified stock differentiates various classes of common

Q75: Legal and economic differences among countries,although important,do

Q84: The NPV method's assumption that cash inflows

Q117: If an investor buys enough stocks,he or