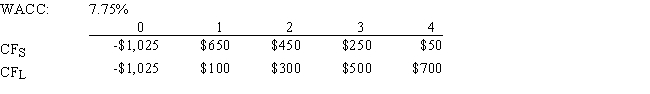

Moerdyk & Co.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV,i.e. ,no conflict will exist.

Definitions:

Accountants

Professionals who perform financial functions related to the collection, accuracy, recording, analysis, and presentation of a business, organization, or individual's financial operations.

Business Judgments

Decisions made in the management of a company that are based on reasonable information and belief for the benefit of the company.

Maturity Stage

A phase in the life cycle of a product, business, or industry where growth stabilizes and is characterized by steady sales and profitability.

Venture Growth

The expansion and scaling up of a startup or new enterprise, typically marked by increased revenue, customer base, or market share.

Q6: If the IRR of normal Project X

Q9: Stock A has an expected return of

Q13: Which of the following statements is CORRECT?<br>A)

Q50: The cost of capital used in capital

Q57: Assume that you are a consultant to

Q65: The cost of preferred stock to a

Q66: Which of the following statements is CORRECT?<br>A)

Q67: Thomson Media is considering some new equipment

Q92: Which of the following statements is CORRECT?<br>A)

Q108: Variance is a measure of the variability