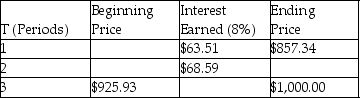

Complete the following zero-coupon amortization schedule.

Definitions:

Risk Aversion

The tendency of investors to prefer lower risk or safer investments to avoid potential losses.

Portfolio Beta

A measure of a portfolio's volatility in relation to the market as a whole; it indicates the sensitivity of the portfolio's returns to market movements.

SML Shifts

Changes in the Security Market Line, a graphical representation of the Capital Asset Pricing Model (CAPM) that shows different levels of systematic, or market, risk versus return for the whole market.

Risk-Free Rate

The theoretical rate of return of an investment with zero risk, typically associated with government bonds.

Q6: When computing the total cash outflow needed

Q17: Beta is _.<br>A)a measure of systematic risk<br>B)a

Q20: Puckett Corp.has just issued nonconvertible preferred stock

Q44: Your firm has an average-risk project under

Q52: The rates on Treasury bills in the

Q58: The question "What is the current value

Q59: The last dividend (Div0)is $1.80,the growth rate

Q67: Pandora,Inc.is considering a five-year project that has

Q79: Your firm has an average-risk project under

Q82: In 1970,before the era of major league