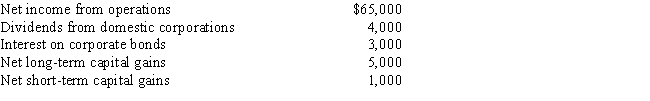

The partnership of Truman and Hanover realized the following items of income during the current tax year: Both the partners are on a calendar year basis.What is the total income which should be reported as ordinary income from business activities of the partnership for the current tax year?

Definitions:

Profit Opportunities

Situations where individuals or firms can earn excess returns due to discrepancies in information, prices, or resources.

Economic Losses

Financial losses experienced by individuals, businesses, or economies as a result of factors such as poor investment decisions, natural disasters, or market downturns.

Supply Curve

A graphical representation showing the relationship between the price of a good and the quantity of the good that suppliers are willing to sell.

Exit

The process by which businesses cease operations and leave a market, often due to unprofitability or strategic realignment.

Q2: Sabrina contributes a building with an adjusted

Q21: The launch of a new cereal typically

Q27: Michael invests in Buxus Interests,a partnership.Michael's capital

Q29: Office Max provides low product prices for

Q37: A single taxpayer,who is not a dependent

Q45: Recently,the $9.5 billion-a-year U.S.ready-to-eat (RTE)cereal market has

Q47: When using share points to make marketing

Q70: Debbie and Betty operate the D &

Q116: Customization refers to<br>A)the specialization in one very

Q265: Consider Figure 22-8: General Mills Marketing Dashboard