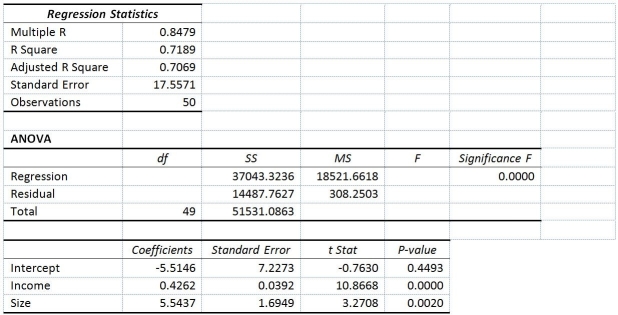

TABLE 14-4

A real estate builder wishes to determine how house size (House) is influenced by family income (Income) and family size (Size) .House size is measured in hundreds of square feet and income is measured in thousands of dollars.The builder randomly selected 50 families and ran the multiple regression.Partial Microsoft Excel output is provided below:  Also SSR (X1 ∣ X2) = 36400.6326 and SSR (X2 ∣ X1) = 3297.7917

Also SSR (X1 ∣ X2) = 36400.6326 and SSR (X2 ∣ X1) = 3297.7917

-Referring to Table 14-4,at the 0.01 level of significance,what conclusion should the builder draw regarding the inclusion of Size in the regression model?

Definitions:

Contribution Margin

The difference between the sales revenue and variable costs of a product, indicating how much contributes to covering fixed costs and earning profit.

Contribution Margin

The residual amount from sales income following the deduction of variable expenses, allocated for covering fixed costs and producing profit.

Variable Costs

Expenses that vary in relation to the amount of production or business activity.

Fixed Costs

Costs that do not change with the level of output produced, such as rent and salaries.

Q9: Referring to Table 16-16,what is the Paasche

Q60: Referring to Table 17-10,Model 1,what is the

Q68: True or False: Referring to Table 15-4,there

Q95: Based on the following scatter plot,which of

Q105: Referring to Table 16-13,what is the exponentially

Q223: True or False: Referring to Table 17-10,Model

Q239: Referring to Table 14-11,which of the following

Q280: True or False: Referring to Table 14-17,the

Q285: Referring to Table 14-7,the department head wants

Q300: Referring to Table 14-15,what is the standard