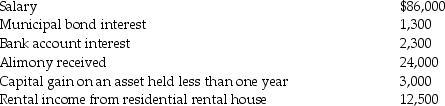

During the current year,Donna,a single taxpayer,reports the following items income of income and expenses:

Income:  Expenses/losses:

Expenses/losses:  Compute Donna's taxable income.(Show all calculations in good form.)

Compute Donna's taxable income.(Show all calculations in good form.)

Definitions:

Fair Labor Standards Act

An act that set rules for the employment of workers, including minimum wage levels, hours of work, and conditions for overtime.

Labor Management Relations Act

The Labor Management Relations Act (or Taft-Hartley Act) (1947) was a response to public outcries against a wide variety of strikes in the years after World War II; its basic purpose was to curtail and limit union practices.

Occupational Safety and Health Act

A law enacted to ensure that employers provide employees with an environment free from recognized hazards, such as exposure to toxic chemicals, excessive noise levels, mechanical dangers, heat or cold stress, or unsanitary conditions.

Taft-Hartley Act

A United States federal law passed in 1947 that restricts the activities and power of labor unions.

Q11: The term "principal place of business" includes

Q16: The USDA food plan used to calculate

Q24: Chloe receives a student loan from a

Q32: Frank loaned Emma $5,000 in 2013 with

Q40: Some of the main factors that influence

Q45: Discuss the tax treatment of a nonqualified

Q59: During the current year,Donna,a single taxpayer,reports the

Q64: For the years 2011 through 2015 (inclusive)Mary,a

Q88: Lori had the following income and losses

Q99: Juan has a casualty loss of $32,500