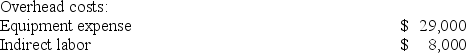

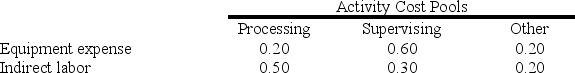

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

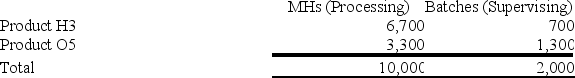

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity: The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Military Spending

The financial allocation by a government for maintaining and equipping its armed forces, including expenses for salaries, equipment, and operations.

Consumer Spending

The total value of goods and services purchased by households during a specific period, an important component of a country's gross domestic product (GDP).

2001 Recession

A brief economic downturn that occurred in the United States in 2001, marked by a decrease in GDP and triggered by the burst of the dot-com bubble.

Federal Government

The national government of a federated state, which is responsible for certain functions such as defense and monetary policy.

Q1: Oriental Corporation has gathered the following data

Q15: Puello Corporation has provided the following data

Q46: Addleman Corporation has an activity-based costing system

Q51: Dock Corporation makes two products from a

Q54: The management of Lanzilotta Corporation is considering

Q55: Eyestone Corporation has two divisions, A and

Q76: Tubaugh Corporation has two major business segments--East

Q142: Ober Corporation, which has only one product,

Q187: Smidt Corporation has provided the following data

Q256: Carradine Corporation uses a job-order costing system