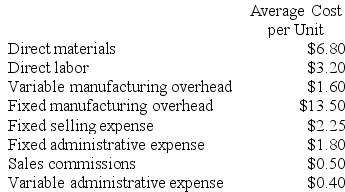

Balerio Corporation's relevant range of activity is 7,000 units to 11,000 units. When it produces and sells 9,000 units, its average costs per unit are as follows:

Required:

Required:

a. For financial reporting purposes, what is the total amount of product costs incurred to make 9,000 units?

b. If 10,000 units are sold, what is the variable cost per unit sold?

c. If 10,000 units are sold, what is the total amount of variable costs related to the units sold?

d. If the selling price is $18.20 per unit, what is the contribution margin per unit sold?

e. What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units?

Definitions:

Preaching

The act of delivering a religious message or sermon, often based on scripture, to a group of people.

Courteous

Showing consideration, respect, and politeness in one's behavior and interactions with others.

Rubber Stamps

Tools typically made of rubber or a similar material attached to a handle or block, used for imprinting designs, signatures, or information by pressing it onto a surface.

Goodwill

An intangible asset representing the value of a company's brand, customer base, reputation, and positive employee relations.

Q1: Division G makes a part that it

Q11: In order to receive $12,000 at the

Q12: Bellucci Corporation has provided the following information:

Q13: Macumber Corporation has two operating divisions--an Atlantic

Q19: A tile manufacturer has supplied the following

Q45: Waltermire Corporation has provided the following information

Q92: Manjarrez Corporation has provided the following information

Q137: Houze Corporation has provided the following information

Q183: Nussbaum Corporation has provided the following contribution

Q201: Sannella Corporation produces and sells a single