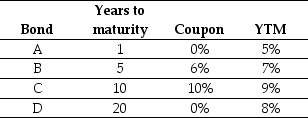

Use the table for the question(s) below.

Consider the following four bonds that pay annual coupons:

-The amount that the price of bond "B" will change if its yield to maturity increases from 7% (Price0) to 8% (Price1) is closest to:

Definitions:

Fetus

A developing human from approximately the end of the eighth week after conception until birth.

Prenatal Development

The process of growth and development within the womb from the formation of an embryo through to the development of a fetus until birth.

Central Nervous System

The Central Nervous System (CNS) is comprised of the brain and spinal cord, functioning as the main processing center for the entire nervous system, controlling thoughts, movements, and bodily functions.

Lanugo

Lanugo is fine, soft hair that covers the body of a fetus or a newborn as a form of insulation, which is usually shed before or shortly after birth.

Q2: Assuming that Tom wants to maintain the

Q10: Assuming you currently have 10,000 Bbls of

Q22: The enterprise value of CCM corporation is

Q23: Taggart Transcontinental currently has a bank loan

Q37: You expect KT Industries (KTI)will have earnings

Q39: Which of the following is true of

Q48: Assuming that the risk-free rate is 4%

Q49: Suppose that Google stock has a beta

Q85: How does scenario analysis differ from sensitivity

Q85: If Moon Corporation's gross margin declined,which of