Multiple Choice

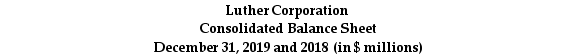

Use the table for the question(s) below.

Consider the following balance sheet:

-If in 2019 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then Luther's market-to-book ratio would be closest to:

Definitions:

Related Questions

Q3: Vermont Home Builders conducted a study of

Q7: Which of the following customer relationship marketing

Q11: Assume the appropriate discount rate for this

Q18: The maximum number of incremental IRRs that

Q29: Which of the following is true of

Q42: If Moon Corporation has an increase in

Q46: Name and describe the seven key steps

Q57: Which of the following is a product

Q60: Which of the following statements is FALSE?<br>A)It

Q68: In addition to the balance sheet,income statement,and