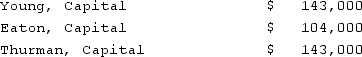

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Eaton's total share of net income for the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Eaton's total share of net income for the second year?

Definitions:

Message Distribution

The process of disseminating information or content to a target audience through various channels.

Readability

The ease with which a reader can understand written text based on factors like sentence structure, vocabulary, and layout.

Security

Measures or mechanisms put in place to protect against theft, espionage, or harm.

Document Design

The process of creating a document in a way that is visually appealing and easy to read, often through the thoughtful layout of text and images.

Q16: On January 1, 2021, Lamb and Mona

Q18: A method of accounting for infrastructure assets

Q35: A partnership began its first year of

Q35: How do intra-activity and interactivity transactions differ

Q46: A partnership began its first year of

Q57: On March 1, 2021, Mattie Company received

Q76: What are the broad classifications of funds

Q80: A local partnership has two partners, Jim

Q91: Under the temporal method, property, plant &

Q95: What is the justification for the remeasurement