Figure 11-3

Figure 11-3

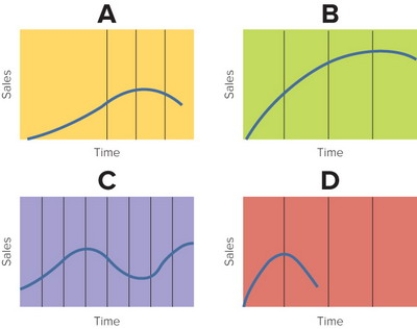

-The product life cycle shown in Box B in Figure 11-3 above represents a ________ product.

Definitions:

Federal Personal Income Tax

A tax levied by the U.S. federal government based on an individual's income, including wages, salaries, and investments.

Taxable Income

The portion of an individual's or entity's income used to determine how much tax is owed to the government.

Marginal Tax Rate

The amount of tax paid on an additional dollar of income, which varies depending on income levels and tax brackets.

Federal Personal Income Taxes

Taxes imposed by the federal government on the annual income of individuals or households.

Q14: Alana operates a wedding preparation service that

Q41: While pricing objectives frequently reflect corporate goals,

Q47: Which statement about product lines is most

Q179: Managers often use two special measures to

Q180: Managing for long-run profits as a pricing

Q205: Products that are purchased by the ultimate

Q223: According to the concept of the diffusion

Q246: When a product spreads through the population,

Q303: Reducing the number of features, qualities, or

Q331: The launch by Gatorade of Gatorade chews,