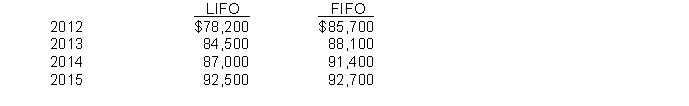

In 2015, Fischer Corporation changed its method of inventory pricing from LIFO to FIFO. Net income computed on a LIFO as compared to a FIFO basis for the four years involved is: (Ignore income taxes.)

Instructions

(a) Indicate the net income that would be shown on comparative financial statements issued at 12/31/15 for each of the four years, assuming that the company changed to the FIFO method in 2015.

(b) Assume that the company had switched from the average cost method to the FIFO method with net income on an average cost basis for the four years as follows: 2012, $80,400; 2013, $86,120; 2014, $90,300; and 2015, $93,600. Indicate the net income that would be shown on comparative financial statements issued at 12/31/15 for each of the four years under these conditions.

(c) Assuming that the company switched from the FIFO to the LIFO method, what would be the net income reported on comparative financial statements issued at 12/31/15 for 2012, 2013, and 2014?

Definitions:

Securities Act

A law enacted in 1933 that governs the initial sale of securities (stocks, bonds) by regulating the offer and sale of these securities to protect investors from fraud.

Auditor

A professional who examines the financial records of an organization to ensure accuracy, compliance with standards, and to suggest improvements.

Delegate Duty

A concept where an individual or entity assigns responsibilities or tasks to another party, typically to ensure tasks are completed by those with specific expertise.

Professional

An individual who is expert and skilled in a particular field, typically requiring specialized education and training.

Q14: The return on common stock equity for

Q17: The focus of APB Opinion No. 22

Q20: sells machinery to Beck Corp. at its

Q26: Companies should disclose all of the following

Q50: An operating segment is a reportable segment

Q56: The deferred tax asset to be recognized

Q57: In computing the present value of the

Q74: The following differences enter into the reconciliation

Q95: Tanner, Inc. incurred a financial and taxable

Q101: In accounting for a pension plan, any