SCENARIO 16-13

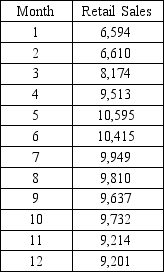

Given below is the monthly time series data for U.S.retail sales of building materials over a specific year.

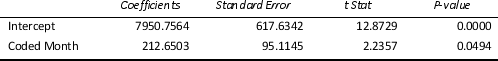

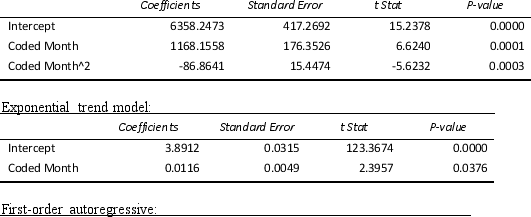

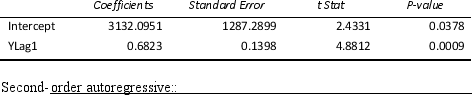

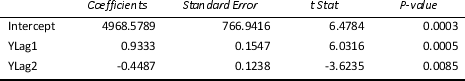

The results of the linear trend,quadratic trend,exponential trend,first-order autoregressive,second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the 1st month is 0:

The results of the linear trend,quadratic trend,exponential trend,first-order autoregressive,second-order autoregressive and third-order autoregressive model are presented below in which the coded month for the 1st month is 0:

Linear trend model:

Quadratic trend model:

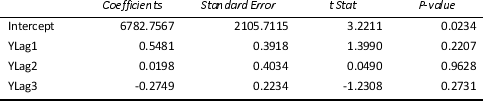

Third-order autoregressive::

Third-order autoregressive::

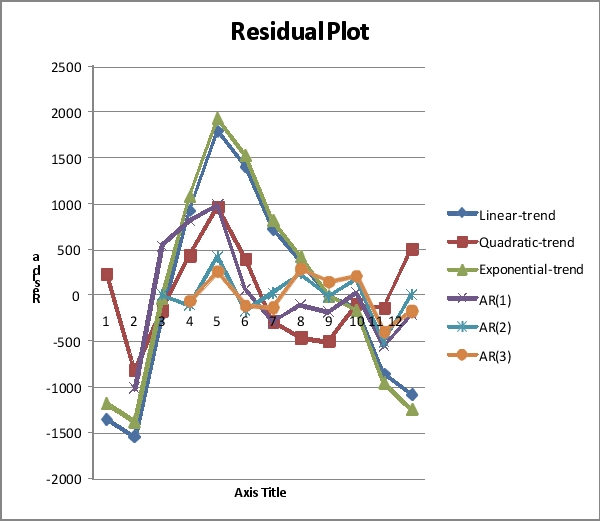

Below is the residual plot of the various models:

-Referring to Scenario 16-13,what is the exponentially smoothed forecast for the 13th month using a smoothing coefficient of W = 0.5 if the exponentially smooth value for the 10th and 11th month are 9,746.3672 and 9,480.1836,respectively?

Definitions:

Stockholders' Equity

The residual interest in the assets of a corporation after deducting liabilities, represented by the owners' claims against the company's assets.

Stock Dividend

Shareholders receive additional shares as a payment from a corporation, rather than receiving cash.

Preferred Stock

A class of ownership in a corporation that has a higher claim on assets and earnings than common stock, often with dividends that are paid out before those of common stockholders.

Par Value

The nominal value of a bond or stock as declared by the issuer, which may not reflect its actual market value.

Q11: Referring to Scenario 14-17,there is sufficient evidence

Q35: The annual multiplicative time-series model does not

Q37: Some consider bullet graphs little more than

Q53: Referring to Scenario 18-8,you can conclude

Q63: Referring to Scenario 17-3,the highest probability of

Q128: Referring to Scenario 16-13,what is the p-value

Q170: Referring to Scenario 18-12,what is the p-value

Q171: Referring to Scenario 14-17,the null hypothesis<br>H<sub>0</sub>:

Q180: Referring to Scenario 18-10 Model 1,which

Q285: Data on the amount of money made