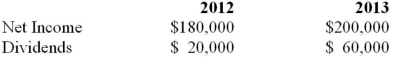

Hot Inc. owns 60% of Cold Inc, which it purchased on January 1, 2012 for $540,000. On that date, Cold's retained earnings and common stock were valued at $100,000 and $250,000 respectively. Cold's book values approximated its fair market values on that date, with the exception of the company's Inventory and a patent identified on acquisition. The patent had an estimated useful life of 10 years from the date of acquisition. The inventory had a book value that was $10,000 in excess of its fair value, while the patent had a fair market value of $50,000. Hot uses the equity method to account for its investment in Cold Inc. The inventory on hand on the acquisition date was sold to outside parties during the year. Hot Inc. sold depreciable assets to Cold on January 1, 2012, at a loss of $15,000. On January 1, 2013, Cold sold depreciable assets to Hot at a gain of $10,000 Both assets had a remaining useful life of 5 years on the date of their intercompany sale. During 2012, Cold sold inventory to Hot in the amount of $18,000. This inventory was sold to outside parties during 2013. During 2013, Hot sold inventory to Cold for $45,000. One third of this inventory was still in Cold's warehouse on December 31, 2013. All sales (both internal and external) are priced to provide the seller with a mark-up of 50% above cost. Cold's Net Income and Dividends for 2012 and 2013 are shown below.  Both companies are subject to a tax rate of 20%. Compute the amount of income tax that would be deferred as at December 31, 2013.

Both companies are subject to a tax rate of 20%. Compute the amount of income tax that would be deferred as at December 31, 2013.

Definitions:

SAT Score

A standardized test score used in the United States for college admissions, reflecting a testee's aptitude in areas such as math, reading, and writing.

College-Bound Seniors

High school students who have plans or have been accepted to attend a college or university for further education.

Social Inequality

Varied social positions or statuses within a society or group face unequal access to opportunities and rewards.

Parental Home Environment

The atmospheric and relational conditions within a child's home, including parenting styles and family dynamics, which influence development and behavior.

Q4: Which of the following theories does NOT

Q4: ABC123 Inc has decided to purchase 100%

Q12: Economic Order Quantity, timing of orders and

Q16: X Inc. owns 80% of Y Inc.

Q26: How may a not-for-profit organization account for

Q28: The predecessor to the International Accounting Standards

Q41: If a not-for-profit organization that has had

Q59: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" Prepare

Q60: Nichols Corporation allocates administrative costs on the

Q78: The largest managerial accounting professional association in