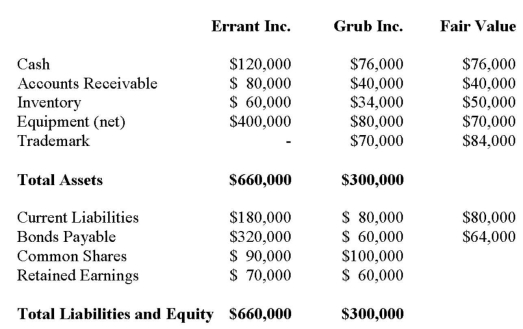

Errant Inc. purchased 100% of the outstanding voting shares of Grub Inc. for $200,000 on January 1, 2012. On that date, Grub Inc. had common stock and retained earnings worth $100,000 and $60,000, respectively. Goodwill is tested annually for impairment. The Balance Sheets of both companies, as well as Grub's fair market values on the date of acquisition are disclosed below:  The net incomes for Errant and Grub for the year ended December 31, 2012 were $160,000 and $90,000 respectively. Grub paid $9,000 in Dividends to Errant during the year. There were no other inter-company transactions during the year. Moreover, an impairment test conducted on December 31, 2012 revealed that the Goodwill should actually have a value of $20,000. Both companies use a FIFO system, and most of Grub's inventory on the date of acquisition was sold during the year. Errant did not declare any dividends during the year. Assume that Errant Inc. uses the Equity Method unless stated otherwise. Assuming that Errant uses the Cost Method, what would be the journal entry to record the dividends received by Errant during the year?

The net incomes for Errant and Grub for the year ended December 31, 2012 were $160,000 and $90,000 respectively. Grub paid $9,000 in Dividends to Errant during the year. There were no other inter-company transactions during the year. Moreover, an impairment test conducted on December 31, 2012 revealed that the Goodwill should actually have a value of $20,000. Both companies use a FIFO system, and most of Grub's inventory on the date of acquisition was sold during the year. Errant did not declare any dividends during the year. Assume that Errant Inc. uses the Equity Method unless stated otherwise. Assuming that Errant uses the Cost Method, what would be the journal entry to record the dividends received by Errant during the year?

Definitions:

Transferring Risk

Shifting potential financial loss to another party through mechanisms like insurance, hedging, or outsourcing, to manage vulnerability to risk.

Investing

The process of distributing funds or resources with the aim of earning a return or profit.

Interest Income

Income earned from deposit accounts or investments that pay interest, such as bonds and savings accounts.

Financial Assets

Assets that derive value from a contractual claim, such as stocks, bonds, bank deposits, and other investments.

Q1: Whine purchased 80% of the outstanding voting

Q6: When the acquisition differential is calculated and

Q11: Whine purchased 80% of the outstanding voting

Q16: Any excess of fair value over book

Q30: Intercompany profits on sales of inventory are

Q32: Errant Inc. purchased 100% of the outstanding

Q35: King Corp. owns 80% of Kong Corp.

Q48: A controller is normally involved with preparing

Q57: Using the step-down method and assuming that

Q66: Which of the following methods would be