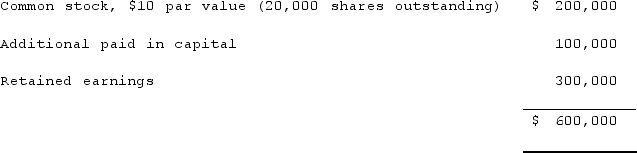

Panton, Inc. acquired 18,000 shares of Glotfelty Corp. several years ago for $30 per share when Glotfelty had a book value of $450,000. Before and after that time, Glotfelty's stock traded at $30 per share. At the present time, Glotfelty reports the following stockholders' equity:

Glotfelty issues 5,000 shares of previously unissued stock to the public for $22 per share. None of this stock is purchased by Panton.Describe how this transaction would affect Panton's books.

Glotfelty issues 5,000 shares of previously unissued stock to the public for $22 per share. None of this stock is purchased by Panton.Describe how this transaction would affect Panton's books.

Definitions:

Total Quality Management

An organizational approach that seeks continuous improvement in all aspects of operations through the involvement of all employees, aiming to achieve long-term success through customer satisfaction.

Organization-Wide Commitment

A unified dedication across all levels of an organization to achieve its mission, values, and goals.

Continuous Improvement

An ongoing effort to enhance products, services, or processes by making incremental improvements over time or through significant changes at once.

Market Research Surveys

The collection of information and insights from targeted market segments to assess preferences, behaviors, and perceptions regarding products or services.

Q13: Matthews Co. acquired all of the common

Q15: On January 1, 2018, Vacker Co. acquired

Q43: On October 1, 2021, Eagle Company forecasts

Q79: McCoy has the following account balances as

Q82: A subsidiary of Dunder Inc., a U.S.

Q86: Kaye Company acquired 100% of Fiore Company

Q93: Thomas Inc. had the following stockholders' equity

Q95: For each of the following situations, select

Q100: The following are preliminary financial statements for

Q108: Following are selected accounts for Green Corporation