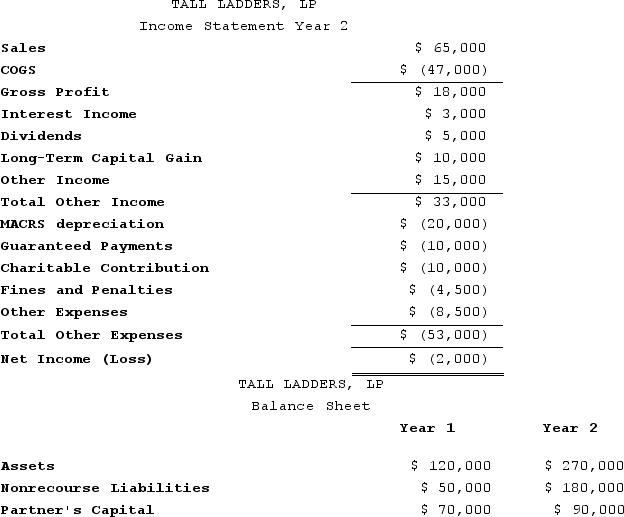

At the end of Year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For Year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following income statement and balance sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of Year 2?

Definitions:

Opposite Directions

A term potentially used to describe actions or movements that are completely contrary to each other in orientation or aim.

Total Revenue

The total amount of money earned from the sale of goods or services before deducting any costs.

Price

The sum of money needed to buy a product or service.

Inelastic

A description of a product's demand when its price elasticity is less than one, indicating that demand is relatively unresponsive to price changes.

Q24: Big Company and Little Company are both

Q29: Which of the following is not a

Q41: The tax basis of property received by

Q49: Given the following tax structure, what is

Q49: Doris owns a one-third capital and profits

Q57: An S corporation can use a noncalendar

Q87: The recipient of a taxable stock distribution

Q89: Which of the following statements regarding disproportionate

Q103: Given the following tax structure, what is

Q107: Which of the following classes of stock