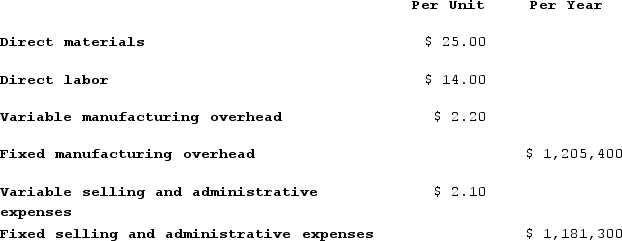

Kirgan, Incorporated, manufactures a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 82,000 units per year.The company has invested $230,000 in this product and expects a return on investment of 16%.The selling price based on the absorption costing approach would be closest to: (Do not round intermediate calculations.)

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 82,000 units per year.The company has invested $230,000 in this product and expects a return on investment of 16%.The selling price based on the absorption costing approach would be closest to: (Do not round intermediate calculations.)

Definitions:

WACC

Stands for Weighted Average Cost of Capital, which calculates a firm's cost of capital, considering the proportion of each capital component, including debt and equity.

NPV

Net Present Value (NPV) is the calculation used to find today’s value of a future stream of payments, subtracting the initial investment.

Cash Flow

The complete financial movement into and out of a corporation, especially regarding its liquidity.

Equivalent Annual Annuity

A calculation used to compare the returns of investments with different payment schedules by converting them into an equivalent sum received at regular annual intervals.

Q59: Which of the following would be classified

Q114: Fabrick Company's quality cost report is to

Q124: A cost center is a responsibility center.

Q183: Rapozo Corporation has provided the following information

Q201: The Hum Division of the Ho Company

Q215: Ahrends Corporation makes 70,000 units per year

Q291: Morice Industries Incorporated has developed a new

Q390: Mcniff Corporation makes a range of products.

Q393: Glover Company makes three products in a

Q393: Coache Corporation is considering a capital budgeting