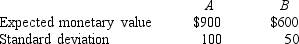

SCENARIO 20-3

The following information is from 2 investment opportunities.

-Referring to Scenario 20-3,which investment has the optimal coefficient of variation?

Definitions:

Equity

The value of an ownership interest in property, including shareholders' equity in a corporation.

Risk-Free Rate

The theoretical return on an investment with zero risk, typically associated with government bonds.

Call Option

A financial contract giving the buyer the right, but not the obligation, to purchase an asset at a specified price within a certain time frame.

Strike Price

The predetermined price at which an option's underlying asset can be bought or sold.

Q38: Referring to Scenario 20-5, what is the

Q57: Referring to Scenario 19-3, suppose the analyst

Q92: Referring to Scenario 20-2, what is the

Q93: Referring to Scenario 18-10 Model 1, the

Q115: In a local cellular phone area, company

Q133: Referring to Scenario 19-7, an R chart

Q133: Referring to Scenario 18-10 Model 1, what

Q152: Referring to Scenario 19-6, a p control

Q183: Referring to Scenario 18-1, what minimum annual

Q256: Referring to Scenario 18-2, what is your