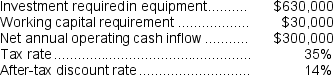

Ariel Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Strong Situations

Contexts or scenarios that significantly determine individual behavior through clear cues and expected actions.

Extraversion

A personality trait characterized by outgoingness, high energy, and sociability, often influencing an individual's approach to social interactions.

Social Situations

Various environments or contexts in which individuals interact with each other, governed by social norms and cultural standards.

Conscientiousness

A characteristic of being well-organized, reliable, and having a deep commitment to responsibilities.

Q12: The present value of a given future

Q23: The income tax expense in year 2

Q34: The net cash provided by (used in)operating

Q61: Financial measures such as ROI are generally

Q70: Which of the following is correct regarding

Q94: A company anticipates incremental net income (i.e.,incremental

Q131: The net cash provided by (used in)investing

Q135: The markup percentage on absorption cost is

Q141: When a company is cash poor,a project

Q158: A disadvantage of vertical integration is that