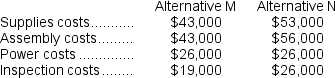

Saalfrank Corporation is considering two alternatives that are code-named M and N.Costs associated with the alternatives are listed below:

Required:

Required:

a.Which costs are relevant and which are not relevant in the choice between these two alternatives?

b.What is the differential cost between the two alternatives?

Definitions:

Direct Labor Costs

Direct labor costs involve the expenditure or expense directly linked to the remuneration of employees who are engaged in the hands-on production of goods or services.

Predetermined Overhead Rate

An estimated overhead rate used to allocate manufacturing overhead costs to products or job orders based on a selected activity base, such as direct labor hours.

Estimated Overhead

Projected costs of indirect materials, labor, and other expenses that are necessary for production but are not directly traceable to specific products.

Allocation Factor

A criterion or formula used to distribute costs or revenues among various departments, products, or projects based on relevant measures such as time, usage, or volume.

Q26: Demand for a product is said to

Q33: For performance evaluation purposes,how much of the

Q36: Fox Company has the following data concerning

Q72: The residual income for this year's investment

Q72: Shular Products,Inc.,has a Valve Division that manufactures

Q77: The income tax expense in year 3

Q79: What is the delivery cycle time?<br>A) 4

Q129: Benjamin Company produces products C,J,and R from

Q145: (Ignore income taxes in this problem.)Fossa Road

Q153: If direct labor hours are the constraint,then