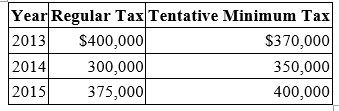

Tropical Corporation was formed in 2013. For 2013 through 2015, its regular and tentative minimum tax were as follows:

a. Compute Tropical's tax due for each year.

a. Compute Tropical's tax due for each year.

b. In 2016, Tropical's regular taxable income is $2,000,000, and it has positive AMT adjustments of $500,000 and AMT preferences of $600,000. Compute Tropical's regular tax, tentative minimum tax, and tax due for 2016.

Definitions:

Technical Skills

Specific abilities and knowledge related to practical tasks within particular fields, requiring specialized training or experience.

Supervisor

A person in authority who oversees and directs the work of others, ensuring tasks are completed efficiently and effectively.

Smartphone Ringtone

A specific sound set on a smartphone that plays to alert the user of an incoming call, message, or notification.

Jackhammering

typically refers to the operation of a jackhammer tool for breaking up concrete or rock, or metaphorically, it could mean persistently working or questioning in a forceful manner.

Q1: Mega, Inc., a U.S. multinational, has pretax

Q21: Waters Corporation is an S corporation with

Q25: Calliwell Corporation is a Colorado corporation engaged

Q40: Which of the following items is not

Q53: Johnson Inc. and C&K Company entered into

Q54: A guaranteed payment may be designed to

Q59: In 2015, William Wallace's sole proprietorship, Western

Q77: A foreign source dividend received by a

Q77: Lettuca Inc. generated a $77,050 ordinary loss

Q96: Hugo Inc., a calendar year taxpayer, sold