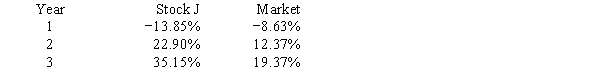

Given the following returns on Stock J and the "market" during the last three years,what is the beta coefficient of Stock J? (Hint: Think rise over run.)

Definitions:

Zero Standard Deviation

A statistical measure indicating that all values within a data set are identical.

Risk-Free Asset

A financial instrument that is considered to have no risk of financial loss, typically government bonds.

Standard Deviation

A statistic that measures the dispersion or variability of a set of data values around the mean (average) of those values.

Expected Profit

The forecasted amount of profit that a business or investment is projected to earn over a specific period.

Q5: Which of the following statements is CORRECT?<br>A)The

Q16: If one Swiss franc can purchase $0.76

Q21: You work for the CEO of a

Q24: Which of the following is NOT a

Q30: Suppose the exchange rate between U.S.dollars and

Q61: As a consultant to First Responder Inc.,you

Q66: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4893/.jpg" alt=" Refer to the

Q68: Gator Fabrics Inc.currently has zero debt .It

Q96: (Applying the Analysis)Payout rates for state lotteries:<br>A)

Q114: Which is a valid counterargument to the