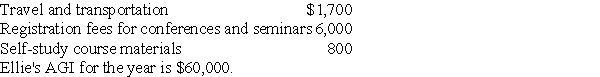

Ellie,a CPA,incurred the following deductible education expenses to maintain or improve her skills:

a.If Ellie is self-employed,what are the amount of and the nature of the deduction for these expenses?

a.If Ellie is self-employed,what are the amount of and the nature of the deduction for these expenses?

b.If,instead,Ellie is an employee who is not reimbursed by her employer,what are the amount of and the nature of the deduction for these expenses (after limitations)?

Definitions:

Assembly Department

A section within a manufacturing facility where components are assembled into final products.

Process Cost System

An accounting system used to track and allocate costs of production by processes or departments, commonly used in industries where goods are produced in a continuous process.

Advertising Company

A business specializing in creating, planning, and handling advertising and sometimes other forms of promotion for its clients.

Chemical Company

A business entity that specifically focuses on the manufacturing, research, and sale of chemicals and chemical-based products.

Q8: In order for a taxpayer to deduct

Q34: If you are a married taxpayer,you may

Q52: Sarah purchased a new car at the

Q65: The term structure of interest rates is

Q68: If prepared properly,financial plans are set for

Q78: Efrain owns 1,000 shares of RJ Inc.common

Q81: Compare using the present value,future value,and annuity

Q84: Bill obtained a new job in Boston.He

Q108: Rob sells stock with a cost of

Q148: Generally,50% of the cost of business gifts