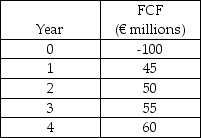

Use the following information to answer the question(s) below.

Hammond Motors is considering an investment in the Euro area.The expected free cash flows,in euros,are uncorrelated with the spot exchange rate and are as follows:  The new project,which Hammond is considering,has similar dollar risk to Hammond's other projects.Hammond knows that its overall dollar WACC is 10%,so it feels comfortable using this WACC for the project.The risk-free interest rate on dollars is 4% and the risk-free interest rate on euros is 6%.Hammond is willing to assume that capital markets in the United States and the Euro area are internationally integrated.

The new project,which Hammond is considering,has similar dollar risk to Hammond's other projects.Hammond knows that its overall dollar WACC is 10%,so it feels comfortable using this WACC for the project.The risk-free interest rate on dollars is 4% and the risk-free interest rate on euros is 6%.Hammond is willing to assume that capital markets in the United States and the Euro area are internationally integrated.

-Hammond's Euro WACC is closest to:

Definitions:

Technological Obsolescence

The state of being outdated or no longer used due to the development of newer and more effective technologies.

Global Competition

The competitive dynamics between companies, industries, or countries on an international scale.

Unionized Organizations

Workplaces where employees are members of a union, a collective organization that negotiates wages, working conditions, and benefits on their behalf.

Collective Agreement

A written contract negotiated between an employer and a union representing the employees, outlining terms of employment, salaries, and working conditions.

Q4: Which of the following statements is FALSE?<br>A)If

Q15: If interest rates are currently 5%,but fall

Q45: Which of the following statements is FALSE?<br>A)The

Q46: If your income tax rate is 30%,then

Q47: Suppose that if GSI drops the price

Q51: Which of the following statements regarding mergers

Q51: You have an investment opportunity that will

Q54: The amount that the price of bond

Q69: At an annual interest rate of 7%,the

Q87: Which of the following statements is FALSE?<br>A)The