Use the following information to answer the question(s) below.

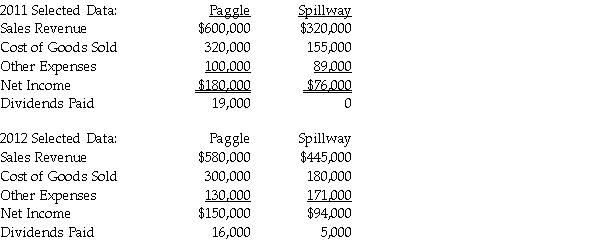

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value.At the time of purchase,the book value and fair value of Spillway's net assets were equal.The two companies report the following information for 2011 and 2012.

During 2011,one company sold inventory to the other company for $50,000 which cost the transferor $40,000.As of the end of 2011,30% of the inventory was unsold.In 2012,the remaining inventory was resold outside the consolidated entity.

-If the intercompany sale was an upstream sale,the total amount of consolidated cost of goods sold for 2012 will be

Definitions:

Oligopoly

A market structure characterized by a small number of firms dominating the market, leading to limited competition.

Monopoly

A market structure characterized by a single seller dominating the entire market for a particular good or service.

Barriers to Entry

Obstacles that make it difficult for new competitors to enter a market, including high startup costs, regulatory requirements, and established brand loyalty.

Substitute Products

Goods or services that can be used in place of another product to satisfy the same need or demand.

Q3: On November 14,2011,Scuby Company (a U.S.corporation)enters into

Q4: CommTex Corporation is liquidating under Chapter 7

Q10: Savy Corporation's stockholders' equity on December 31,2010

Q10: Assume there are routine inventory sales between

Q14: Assume an upstream sale of machinery occurs

Q20: Jeff Corporation owns 90% of the common

Q24: On April 1,2011,Paramount Company acquires 100% of

Q29: Plock Corporation,the 75% owner of Seraphim Company,reported

Q29: Which of the following hedging strategies would

Q185: Under the Federal income tax formula for