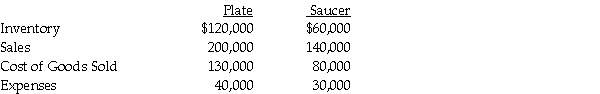

Presented below are several figures reported for Plate Corporation and Saucer Industries as of December 31,2011.Plate has owned 70% of Saucer for the past five years,and at the time of purchase,the book value of Saucer's assets and liabilities equaled the fair value.The cost of the 70% investment was equal to 70% of the book value of Saucer's net assets.At the time of purchase,the fair values and book values of Saucer's assets and liabilities were equal.

In 2010,Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31,2010,but was sold in 2011.In 2011,Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31,2011.

In 2010,Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31,2010,but was sold in 2011.In 2011,Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31,2011.

Required: Calculate following balances at December 31,2011.

a.Consolidated Sales

b.Consolidated Cost of goods sold

c.Consolidated Expenses

d.Noncontrolling interest share of Saucer's net income

e.Consolidated Inventory

Definitions:

Acute Care

Medical treatment given for a brief but severe episode of illness, injury, or surgery, often requiring hospitalization for monitoring, diagnostic testing, or emergency care.

Teen Pregnancy

Pregnancy occurring in individuals under the age of 20.

Dropout Rate

The percentage of individuals who discontinue their education or training before completion within a given period or cohort.

Chronic Environmental Factors

Persistent external conditions in the environment that can influence an individual's health over time.

Q11: Piel Corporation (a U.S.company)began operations on January

Q20: Electronic databases are most frequently searched by

Q30: If an affiliate purchases bonds in the

Q31: For 2011,consolidated net income will be what

Q32: What will the profit and loss sharing

Q65: More rapid expensing for tax purposes of

Q78: What administrative release deals with a proposed

Q84: A parent employs his twin daughters,age 17,in

Q172: Fraud and statute of limitations

Q177: If more IRS audits are producing a