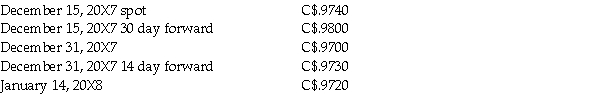

Helvetia Corp. ,a Swiss firm,bought merchandise from Bouchard Company of Quebec on December 15,20X7 for 20,000 CHF,payable on January 14,20X8.Bouchard and Helvetia both close their books on December 31.The 20,000 CHF was paid on January 14,20X8.The exchange rates for CHF1 were:

Required:

Provide the journal entries for Bouchard (the seller)at each of the above dates,as required.The account was hedged by Bouchard through a 30 day forward contract.Bouchard uses the gross method to record hedge transactions.Bouchard reports under IFRS.

Definitions:

Midpoint Evaluations

Periodic assessments conducted halfway through a project, program, or academic term to review progress and adjust goals or methodologies as necessary.

End Evaluations

The assessments conducted at the conclusion of a project or term to review performance and outcomes.

Processing Method

A technique or procedure used to handle or manage information, materials, or products.

Reflect

The act of thinking deeply or carefully about something, often leading to insights or learning.

Q10: How should accounting fees for an acquisition

Q11: Management prepares the company's financial statements.Consequently,management's objectives

Q12: Amber Ltd.purchased 80% of Patel Ltd.for $1,000,000.At

Q13: question mark (?)represented by the wedge DBC

Q18: On January 1,2013,Diab Services issued $140,000 of

Q23: On January 1,20X2,Soho Co.purchased 4,000 shares,representing 12%,of

Q29: of the following were pre-launch issues 3M

Q35: Tooker Co.acquired 80% of the outstanding common

Q163: element of the marketing mix that describes

Q308: Compared to marketing strategies,marketing tactics generally involve